The new Plastic Packaging Tax is due to be introduced on April 1st 2022, as was announced back in 2018. The tax applies to all plastic packaging produced within the UK. Don’t forget – it also applies to imported plastic packaging.

We put together some tips and advice last year, which you can find in our blog – however, now is the time to make sure you’re ready for the incoming changes.

Why is the plastic tax being introduced?

The tax is being introduced to encourage the sustained use of recycled plastic. It aims to encourage businesses to take a look at their plastic use and change their processes. Ultimately – the tax will reduce the amount of plastic we send to landfill.

Plastic packaging which contains less than 30% of recycled plastic will face a tax charge of £210.82 per tonne.

By incentivising the use of recycled plastic, it creates a greater demand for recycled material. This will lead to increased levels of collection, and ultimately, recycling.

For the tax, the term ‘Plastic’ means any material consisting of a polymer. This includes all compostable, biodegradable and oxo-degradable plastics.

For the tax, the term ‘Recycled Plastic’ is plastic that has been reprocessed. There are two types;

Pre-consumer material: Material diverted from the waste stream during a manufacturing process. Excluded is reutilisation of materials such as rework, regrind or scrap capable of being reclaimed within the same process that generated it.

Post-consumer material: Material generated by households, commercial, industrial and institutional facilities in their role as end users of the product, which can no longer be used for its intended purpose. This includes material from the distribution chain.

How can I prepare for the Plastic Tax?

Make sure you are up to date on the rules, and check whether you qualify for exemption. Now is the time to ensure you have made the necessary substitutions in packaging. It could save you being taxed when the new rules come into play.

We recommend creating a spreadsheet listing which of your products contain less than 30% recycled content. These are the most urgent products you’ll need to change. If you need help with this, contact the Packaging Pro’s at Springpack, and we’ll be able to help.

Once you’ve identified these products, you can begin sourcing alternatives. Springpack can help you with this – just e-mail your spreadsheet to [email protected].

For up to date and further information, head over the Government website.

How do I calculate recycled content?

Recycled content is calculated using the mass balance approach:

For example, if plastic bottle weighing 50g has 16g of recycled content, the % recycled content is 32%. This would therefore be exempt from the tax.

Packaging Components

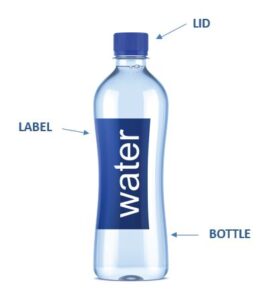

A packaging component is a product that is designed to be suitable for use, whether alone or in combination with other products in the containment, protection, handling, delivery or presentation of goods.

If we use our plastic bottle example from above, there are 3 main components. The bottle itself, the lid and a label. Assuming all are made from plastic, each component must contain >30% recycled content, or be subject to the tax. It is not calculated on the overall pack.

It is also worth noting, that if the packaging contains multiple materials, if plastic is the predominant weight, it will be classed as plastic for the purpose of the tax.

Reporting

As soon as you exceed 10 tonnes of plastics purchased, you have 30 days to register with HMRC. Tax returns must be submitted every quarter, and records of use must be kept. For example, calculations on the packaging weights, and the recycled content percentages.

Documents such as contracts, and invoices can be used as evidence for the above. Keeping up to date records of product specifications would be very beneficial too.

What are the potential impacts on your supply chains?

Like with anything new, there’s usually a mad rush to source the goods, followed by delays caused by a lack of supply. And products containing 30% recycled content are likely to be the same too.

So what else could you do?

- If you haven’t already considered switching to plastic-free packaging, now could be the perfect time.

- Look at ways you can reduce your own plastic usage. Put simply, if you don’t use as much, you won’t need as much!

- Liaise with your suppliers to ensure a smooth transition of products.

- Regularly review your usage, and where possible, offer forecasts to your packaging provider.

If you are able to take the above into account, you should benefit from a smooth transition to using 30% recycled content plastics.

So is anyone exempt from plastic tax?

You may be exempt from the Plastic Tax, as there are four exemptions. These exemptions will not need to pay Plastic Tax, regardless of the amount of recycled plastic they use;

- Medical Packaging – any packaging manufactured or imported for the immediate packaging of medical products

- Transport Packaging – packaging used on goods that have been imported

- Aircraft Packaging – this includes any packaging used as aircraft, ship and rail stores

- Components with other uses than packaging – components that are permanently designated or set aside for use other than a packaging use

How can I improve my environmental operation?

Here at Springpack, we offer free packaging audits to identify how much packaging your company uses. We’ll analyse which areas could benefit from alternative packaging solutions, and help you prepare.

Our environmentally friendly product selection, covers a variety of packaging solutions. All of which will help improve your environmental footprint. We’ve been working hard to provide our customers with environmental alternatives, and we are always striving to add more! We’re particularly keen to help in the midst of the Plastic Tax.

If you’d like to take a look at the range, just click here.

In summary

Here are the key headlines for the Plastic Packaging Tax:

- Plastic Packaging Tax is due to take effect from 1 April 2022.

- The tax will be £200 per tonne (apportionment for part thereof).

- The tax applies to plastic packaging manufactured in or imported into the UK containing less than 30% recycled plastic, when measured by weight.

- It applies to businesses that manufacture or import plastic packaging components, or import packaged goods into the UK.

- If your business is in the UK, you will be liable for Plastic Packaging Tax if you perform the last substantial modification* before the packing or filling process.

- ‘Small operators’ who manufacture or import less than 10 tonnes of plastic packaging in a 12-month period are exempted from the charge.

- There are anti-avoidance rules dealing with the artificial separation of business activities to avoid the tax.

*Last Substantial Modification: Examples of manufacturing processes that are substantial modification processes; this is not an exhaustive list:

Extrusion, Moulding, Layering and Laminating, Forming & Printing

How can we help?

We are currently updating our own stock portfolio, and switching to products containing at least 30% recycled content. We also offer a wide range of plastic-free packaging alternatives, so whether you are looking to reduce your plastic usage, or completely overhaul your packing operation, contact the Packaging Pro’s, and see how we can help!

To get in touch with us regarding swapping products for more eco friendly alternatives, or to receive an audit, you can call us on 01905 457 000 or e-mail [email protected].