If you would like to learn more about Springpack and our services, use the form below to submit an enquiry, or get in touch with one of our packaging experts by…

Plastic Packaging Tax: What You Need to Know

Plastic Packaging Tax: What You Need to Know

In a step towards sustainability, in 2022 the UK government introduced a tax on plastic packaging. The aim of this tax is to encourage manufacturers, importers and consumers who buy packaging goods, to re-think their plastic packaging.

The information in this guide is accurate as of 2025, though we understand the internet is forever, so it might be useful to check the government website if you’re reading this article a few years into the future.

Key Takeaways

• The Plastic Packaging Tax applies to plastic packaging with less than 30% recycled content

• It aims to incentivise the use of recycled materials and reduce reliance on virgin plastic.

• Businesses face a £223.69 per tonne charge for non-compliant packaging (as of 2025)

• The tax may not apply to businesses who manufacture/import/use less than 10 tonnes of plastic packaging per year.

Overview of Plastic Packaging Tax

Introduced in April 2022, the Plastic Packaging Tax (PPT) is a piece of legislation that encourages businesses to use a minimum of 30% recycled content within their packaging.

It applies to plastic packaging with less than 30% recycled content, impacting producers, importers, and users. The tax aims to shift industry practices towards more sustainable options by imposing a financial penalty on non-compliant packaging.

Plastic Packaging Tax Price Rises:

£200 per tonne from 1 April 2022

£210.82 per tonne from 1 April 2023

£217.85 per tonne from 1 April 2024

£223.69 per tonne from 1 April 2025

Is the plastic packaging tax working?

Plastic Packaging Tax Statistics:

When the periods of 2022/23 and 2023/24 are compared, there has been a 78,000 tonne increase of plastic that contained a minimum of recycled content, and a 167,000 tonne decrease of plastic that was taxable.

This shows that the plastic packaging tax is working, and less virgin plastic is entering the supply chain.

*Statistics taken from the UK Government website.

Environmental Goals - Recycled Plastic

The primary objective of the plastic packaging tax was to encourage businesses to use more recycled plastic packaging. It has increased producer responsibility, and over the last few years, data shows that it there has been an increase in the amount of recycled plastic used.

Reducing plastic waste is a key focus of the Plastic Packaging Tax. By creating a financial incentive to use compliant packaging, the tax encourages businesses to adopt practices that align with circular economy principles. This means prioritising recycling and reducing the amount of waste that ends up in landfills.

Why reduce plastic?

It’s no surprise that reducing the amount of single use & virgin materials is beneficial for everybody, and an increased demand for recycled content is a great place to start.

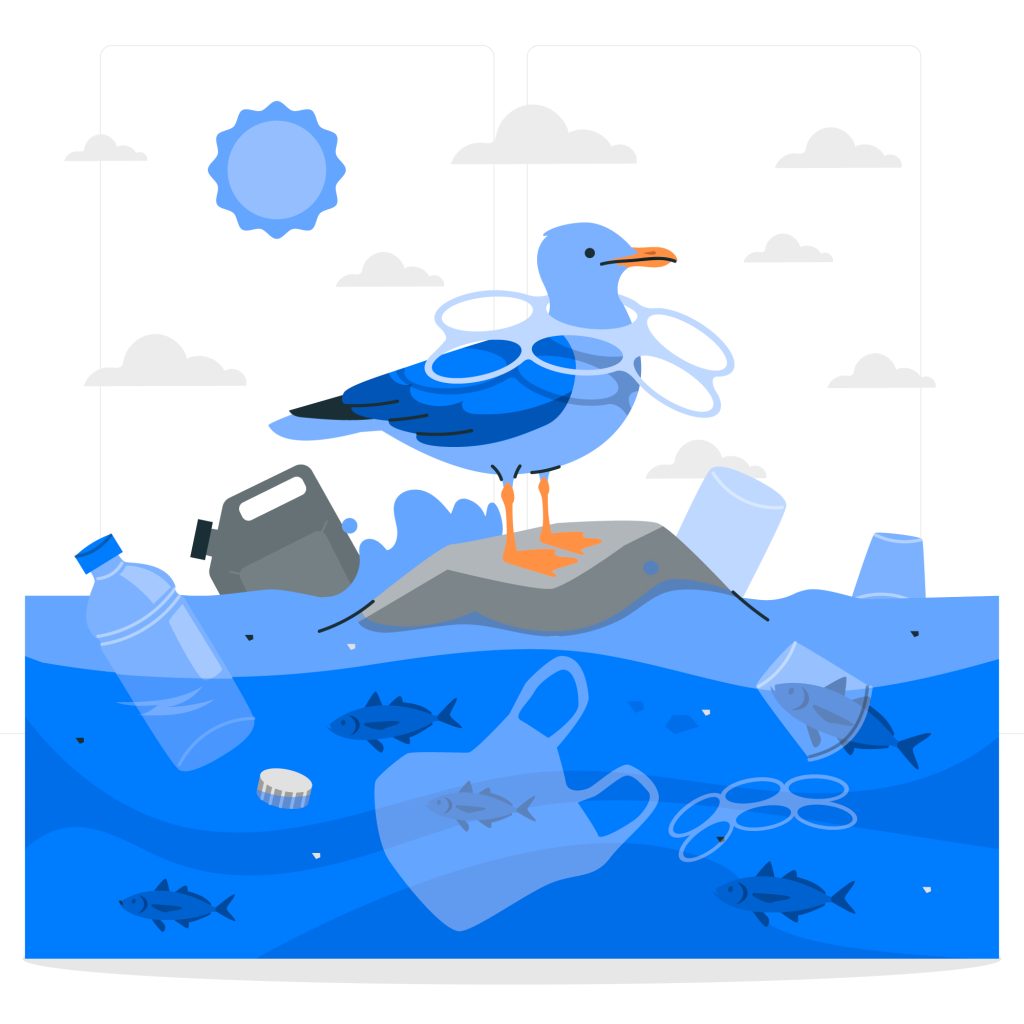

The higher the demand for recycled plastic, the more of an incentive there will be to recycle it in the first place. The reduction of plastic waste has more environmental benefits than we can list in a single post. It contributes to cleaner oceans and habitats, reducing pollution and protecting wildlife from harmful plastics. By encouraging businesses to adopt sustainable practices, the tax plays a crucial role in promoting environmental sustainability and safeguarding natural ecosystems for future generations

Many businesses are switching to paper or eco alternatives, such as Simply Eco by Springpack.

Latest Updates on Plastic Packaging Tax

Staying informed about the latest updates on the Plastic Packaging Tax is crucial for everybody who manufactures, imports or purchases packaging materials. To see the most up to date information about the Plastic Packaging Tax, please visit the government website.

Final thoughts:

The Plastic Packaging Tax is a step towards a sustainable future within the UK. It incentivises businesses to reduce and recycle their plastic. It is working, as the amount of taxable plastic has decreased, and the non taxable has increased.

By staying informed about, and compliant with this legislation, businesses can take the steps they need to create a greener future.

Frequently Asked Questions

What is the plastic packaging tax?

The plastic packaging tax is a tax on plastic packaging that contains less than 30% recycled plastic.

How much tax must be paid?

The amount of tax per tonne changes each year. As of April 2025, this is £223.69 per tonne.

Is all plastic packaging subject to tax?

No. Only plastic packaging that contains less than 30% recycled materials, is subject to the tax.

Do you pay Plastic Packaging Tax on Biodegradable plastic?

Compostable, biodegradable, and bio-based plastics will not be exempt from the plastic packaging tax unless they contain at least 30% recycled plastic. While these alternative materials may have environmental benefits, they will still be subject to the tax if they do not meet the recycled content requirements.

Were Here to Help Guide Inform

Author: Alice Jeavons

Springpack is a UK packaging company delivering sustainable solutions that empower customers. We prioritise exceptional service, building strong relationships and developing innovative packaging solutions tailored to unique needs. Sustainability drives us, from eco-friendly materials to reusable practices minimising waste and emissions. As a family-run business, we’ve grown from humble beginnings to industry forerunners. Our passion lies in making a positive impact in our community and the lives of customers, employees, and stakeholders through outstanding service that exceeds expectations.